Stocks Are Crashing — Here’s How to Protect Your Money Before It Gets Worse

Trump’s tariffs hit, and markets are flailing. Here’s how to protect your money while everyone else scrambles.

The market doesn’t care what you think it should do. It responds to policy, liquidity, and positioning. Last week gave us a clear signal: things are shifting, and we’re all about to get bent over a barrel, here’s how to protect your sphincter…

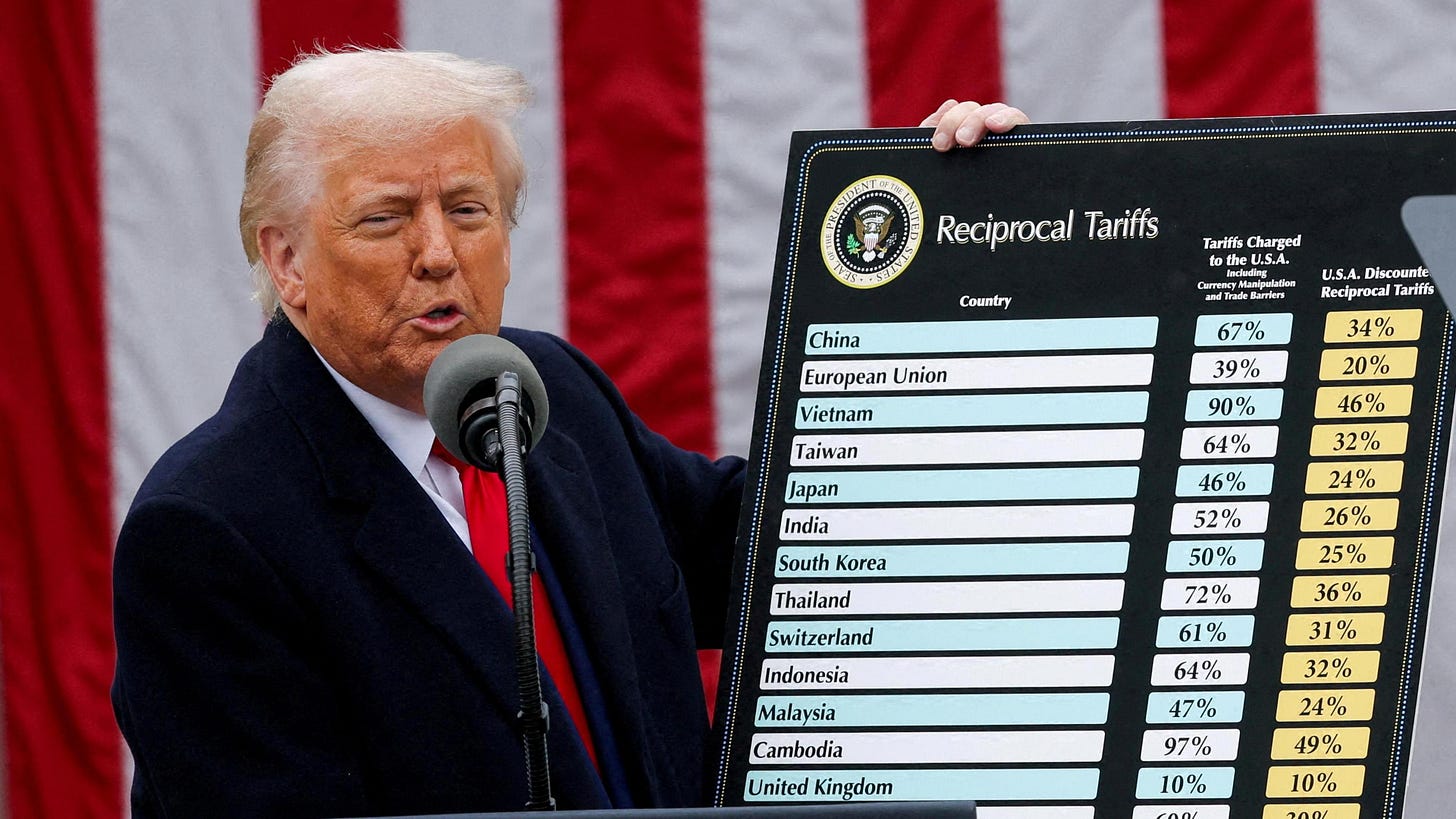

President Trump’s new tariffs on imports and a steep 54% on goods from China—aren’t just campaign bluster. They’re enacted, and they’re hitting the system hard. Nearly $7 trillion in market cap vanished in 48 hours. The Dow shed over 3,900 points in two trading sessions. The Nasdaq dropped 6%, entering official correction territory.

A trade war is now live.

This article is going to be a little longer than my usual, but this is some really important subject matter, and you have a chance to position yourself financially to profit from this disaster so lets dig in…

Tariffs, Pressure, and Capital Flight

A 54% tariff on Chinese goods is a shock to global trade. American importers either absorb that cost or raise prices. Supply chains—already stressed from post-COVID disruptions—get even messier. Margins shrink. Consumer prices rise. And if China retaliates, U.S. exporters face the same pain.

Markets know this. That’s why we’ve seen a broad-based selloff. This isn’t just tech getting smacked. Industrials, materials, discretionary, even financials are under pressure. Nvidia’s dip below $100 is symbolic, not causal. It got downgraded by HSBC due to pricing pressure and export fragility, but the real issue is what that represents: inflated valuations in sectors dependent on uninterrupted trade and cheap capital.

Market Sentiment Has Shifted

Look at positioning. The spike in the VIX to levels not seen since early 2023 is a clear sign that volatility is no longer just noise - markets are starting to price in real risk. This isn’t a minor blip like we saw during the soft landing narratives of late 2023. This is a regime shift. The fear bid is back, and that alone signals a major change in sentiment. It’s the first time since the SVB collapse that we’ve seen volatility meaningfully spike alongside broad-based equity selling.

What’s more telling is the move in bond yields. Normally, when stocks fall, yields drop as investors pile into Treasuries. But not this time. Yields are rising while equities sell off—a classic stagflation signal. That tells us the market is pricing in both slowing growth and persistent inflation, a brutal combo for risk assets. It also implies the Fed’s hands are tied—cutting too soon risks reigniting inflation, while holding too long risks choking growth and tightening credit.

Commodities are also quietly firming. Oil is being bid up due to geopolitical tensions and OPEC supply discipline. Gold is catching flows as a hedge against currency debasement and sovereign risk. Copper’s strength suggests demand isn’t collapsing just yet—but the fact that all three are up while equities drop means capital is hedging against systemic macro shifts.

Meanwhile, cash is outperforming everything. Money market funds, short-duration Treasuries, and T-bills yielding 5%+ are crushing high-beta tech and speculative growth. In a world where “safe” pays better than “risky,” the entire capital stack reprices. Why take duration risk when cash is king?

What we’re not seeing is a healthy rotation. There’s no flight to defensives, no surge into utilities or staples, no rally in bonds as a safety trade. Instead, we’re seeing universal de-risking. Traders aren’t rotating—they’re exiting. High-beta names, unprofitable tech, small caps, and crypto are being sold indiscriminately. This is the start of a deleveraging cycle, plain and simple. You don’t rotate into cyclicals during deleveraging. You raise cash.

This marks the beginning of a macro pivot. Smart money is stepping back, hoarding liquidity, and preparing for a tighter credit environment. Institutional positioning is defensive, not speculative. Hedge funds are reducing gross exposure, and even retail sentiment is starting to sour. This is what pre-recession behaviour looks like. The bullish narrative is fading, and “buy the dip” is being replaced by “preserve capital.”

At the centre of this is the Fed’s credibility. If Powell cuts rates too early, he risks un-anchoring inflation expectations and undermining confidence in monetary policy. If he waits too long, the tightening already baked into the system could spark a credit crisis. Either direction is risky. The window for a “soft landing” is narrowing by the day.

One major risk that hasn’t hit headlines yet is the potential for a credit event. High-yield spreads are quietly widening, and the private credit space is bloated with duration risk and poor covenants. A blow-up in that corner—be it through a default cascade or liquidity mismatch—could trigger a broader selloff as forced deleveraging ripples through the system. This is how systemic stress starts: not with a bang, but with something small snapping under pressure.

A few critical indicators to watch from here: the spread between HYG and LQD, which reflects junk vs investment-grade credit risk; gold’s behaviour against the dollar during stress windows; any decoupling between front-end rates and Fed guidance; and simultaneous deterioration in ISM Services and Consumer Confidence. If these all roll over together, the risk of a hard landing spikes.

This isn’t just another dip or a typical correction. It’s the early phase of an end-of-cycle transition. Whether this morphs into a full-blown recession or just a sharp reset depends entirely on policy response and credit stability. But make no mistake—the risk/reward dynamic has flipped. Smart operators are moving to the sidelines. Retail investors haven’t caught up yet and many will lose a lot trying to catch the falling knife.

How to Trade This Environment

You don’t need to predict the bottom. You need to position correctly for a regime shift. There’s real money to be made when volatility returns, but only if you’re disciplined.

Short the froth

Frothing refers to a market condition where asset prices rise rapidly due to speculation and excessive investor enthusiasm, often detached from underlying fundamentals.

Triple-leveraged inverse ETFs like $SQQQ (Nasdaq), $SPXS (S&P 500), and $REW (tech) are moving again. If you want more juice, WisdomTree’s 5x Short ETFs are viable for short-term trades, but they will eat you alive on chop. Know your exits. Use tight stops. Trade levels, not feelings.

These things aren’t investments — they’re weapons. Designed to rip when the index bleeds, but also to decay like milk in the sun if you hold them too long. The moment volatility contracts or we bounce even a little, they get crushed, fast.

That’s the tradeoff for all that leverage.

Think of them like nitrous in a street race. It gives you power, but if you don’t know when to hit the button — or worse, you keep it on during a hairpin turn — you’re going through the guardrail. You use these when you have a clear, high-conviction setup. Not vibes. Not Reddit hype. Real structure: breakdowns, failed retests, or panic candles with confirmation.

And don’t marry them. These are hit-it-and-quit-it instruments. If you’re holding 5ULS overnight, you need a damn good reason and a defined invalidation point. Otherwise, you’ll wake up to a green open and find 20% of your position evaporated before breakfast.

Focus on the weak hands

Nvidia isn’t alone. ARM is still priced like it’s 2021. SMCI has no business trading where it is without confirmation of sustainable demand. TSLA’s growth story is running on fumes. These are names that got bid up on narratives—now they’re unwinding. Short pops, fade strength.

Nvidia still has the crown, but even kings bleed when multiples get stretched into fantasy land. ARM’s valuation is delusional — it’s riding the coattails of hype without the revenue to justify it. SMCI is a glorified hardware supplier pretending it’s a hypergrowth tech company. One earnings miss and that chart's getting nuked.

Finally Tesla? It’s not a growth stock anymore. You can’t sieg heil and then gaslight the world, even if unintentional, you own up to your mistake, not double down and spew a bunch of nazi jokes Elon, I’m looking at you…

Tesla is a car company with margin pressure, slowing deliveries, and a CEO more focused on trolling the SEC and the American public than building shareholder value. The "tech stock" premium it once carried is fading fast, the drastic drop in sales seen across the globe is spelling trouble for them without a shadow of a doubt.

If you're trading these, trade the reality, not the story. The market isn’t rewarding fairy tales right now. It’s punishing anything that ran too hot. So when these names pop on low volume or shallow news, that’s not a buy signal — it’s a setup.

You short into strength, take profits quick, and don’t get greedy.

Wait for the real bottom

I keep seeing people giddy on Threads or X wanting to buy at discounted prices, but for the love of god, do not try and catch the falling knife.

Don’t DCA into weakness. Wait for signs: a VIX spike over 40, capitulation volume, Fed liquidity response. Until then, cash is a position. Preserve capital and prepare to deploy when risk-reward shifts.

Buying the dip only works when the dip has a floor. Right now, there’s no floor — just trapdoors. DCA-ing blindly here is how you end up bagholding with conviction while your portfolio bleeds out in slow motion.

You want to see real panic. Not Twitter panic — actual fear: volatility screaming, volume flooding in, and central banks stepping in to calm the storm. That’s when you start mapping out your entries. Not before.

Cash isn't weakness. It's optionality. It's the ability to move when others are trapped. So yeah — let them try to catch the falling knife. You wait for the moment when the blade’s on the floor and the room’s stopped spinning.

Hedge with real assets

Gold, oil, and commodities become attractive in a stagflation setup. If the dollar weakens under trade pressure while inflation remains sticky, you’ll want exposure to hard assets. GLD, XLE, and DBC are worth watching.

Stagflation’s a rare beast — slow growth, high inflation, and policy gridlock. It’s brutal for risk assets, but it’s where commodities shine. Gold loves chaos, oil loves supply shocks, and broad commodity baskets give you exposure without having to play roulette on individual names.

If tariffs keep hammering trade routes and input costs, inflation won’t drop — it’ll morph. Not the clean CPI spike we saw in 2022, but a grinding, sticky pressure that eats margins and drags growth. Equities choke on that. Hard assets don’t.

So while everyone’s trying to guess the bottom on tech, smart money is quietly rotating into real stuff — things you can dig out of the ground, not imaginary multiples that vanish when rates rise.

Get out of the middle

Unprofitable mid-cap tech with international exposure is a graveyard right now. No pricing power, no defensive moat, and no liquidity cushion. This is where passive capital goes to die in these cycles. Don’t try to be a hero.

If you want to make money, stop thinking in narratives and start watching liquidity and sentiment. The best trades of this decade won’t be made buying breakouts—they’ll be made fading false rallies and stepping in at the real bottom.

You don’t need to be early. You need to be right. And right now, that means defensive posture, tight risk, and eyes on the tape.

The current direction of travel will inevitably lead to higher prices globally, at the very least, those that are fortunate enough can manage our money in a way where it actually grows throughout this insane market.

Finally all this having been said, I’m just a lowly software engineer with an interest in puzzles and finance, I’m not a financial advisor, and this isn’t financial advice. I’m just sharing my thoughts on the zeitgeist and what’s worked for me. Always do your own research and speak to someone qualified before making any big money moves.