Rocket Lab upcoming earnings: Will it shoot to moon?

Rocket Lab is the only real competitor facing SpaceX and the only real contender that retail can trade, I dig into the company and give me view on the upcoming earnings.

Rocket Lab is due to release their earnings this coming Thusday the 8th of May, 2025. I’ve written about RocketLab a few times on buildingbetter.tech, mostly because the company keeps doing things that make the rest of the small‑launch crowd look like they’re standing still. If you’re new here, here’s the 60‑second refresher.

Who are they?

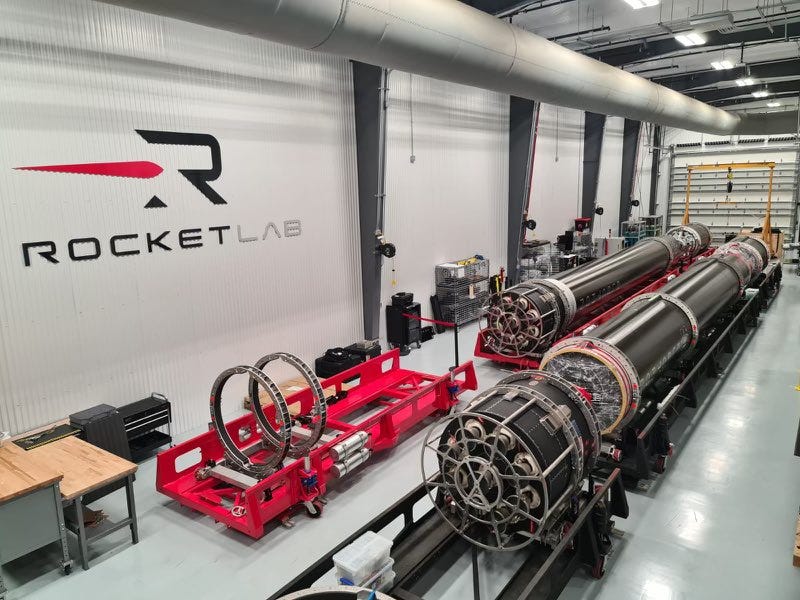

Rocket Lab USA (NASDAQ: RKLB) is the second‑most‑prolific launch provider in the United States behind SpaceX. Their workhorse Electron rocket has flown more than 40 successful missions, and their Photon satellite bus now powers everything from NASA science probes to private‑sector constellations. They’re also deep‑diving into space‑systems manufacturing (solar cells, reaction wheels, star trackers) and, crucially, building the much larger, reusable Neutron rocket to chase megaconstellation and national‑security business.

Why they matter

Responsive launch plus vertically‑integrated spacecraft parts make Rocket Lab a one‑stop shop for getting hardware off the planet quickly—a value prop that resonates with defense customers and commercial operators alike.

Why they have a future

Backlog topped the billion‑dollar mark at the end of last year Satellite Today, Neutron’s first flight remains on track for 2025 SpaceNews, and management continues to snag marquee contracts (more on those in a minute).

Bruised but far from broken

January 23, 2025 was the all‑time high close for RKLB at $31.57 Macrotrends. Since then, the shares have slid roughly 28 % to $22.48 at Monday’s close Yahoo Finance. The culprit isn’t botched launches—it’s macro. President Trump’s new tariff regime kicked off on April 2 and has been whipsawing risk assets ever since, lopping nearly 15 % off the S&P in the first few sessions and injecting a heavy dose of risk‑off into anything labeled “growth” Reuters.

Rocket Lab got caught in that downdraft, plain and simple. Fundamentals didn’t change; the risk‑free rate did.

A year of building—and winning

Rocket Lab Just Secured a Slew of Wins—And They're All Lining Up for Long-Term Growth. They’ve been busy stacking up contracts lately, and it’s starting to look like a serious momentum shift—especially in the defence and commercial satellite markets.

First up, they’ve been selected for the U.S. Air Force’s massive EWAAC IDIQ contract, which has a headline value of $46 billion. That doesn’t mean Rocket Lab gets all of it, but being included opens the door to a steady stream of hypersonic test launches using their new HASTE variant. This could mean recurring work for years—especially as the military keeps ramping up its hypersonics game.

Speaking of HASTE, Rocket Lab also landed a launch contract from Kratos for MACH-TB 2.0. That’s a hypersonic testing programme, and it gives Rocket Lab some near-term revenue while also adding more flight experience to their defence-focused Electron variant. It’s a solid play that strengthens their military credibility.

On the commercial side, they’ve locked in a 10-launch deal with Japanese Earth observation startup Synspective. The agreement runs from 2025 to 2027, which means Rocket Lab already has business locked down years ahead of schedule. That’s a big win in a market where consistent cadence and reliability are everything.

And finally, they scored a $23.9 million subsidy from the CHIPS Act to help expand their SolAero solar-cell production line. That de-risks a chunk of their capital expenditure and helps scale a high-margin part of their Space Systems business. Solar cells might not grab headlines like rockets, but they’re critical for satellites—and they bring in solid margins.

All in all, Rocket Lab’s positioning itself to be more than just a small launcher. They’re quietly becoming a serious end-to-end player in both defence and commercial space.

Operationally, Rocket Lab finished 2024 with record revenue, a $1.067 B backlog, and the Electron posting a 96 % success rate over its lifetime Satellite Today. Management guided to 22+ missions this year—steady enough to cover OpEx while Neutron soaks up R&D.

Thursday’s numbers: what the Street wants

Consensus revenue: $120.7 M (+30 % YoY).

Consensus EPS: ‑$0.10 (slightly wider loss vs. Q1 ’24).

Nasdaq

https://www.tradingview.com/chart/?symbol=NASDAQ%3ARKLB

My read: the top line should be reachable. A chunk of that backlog converts to revenue via Electron launches already flown in Q1 plus Space Systems deliveries. Margin, not revenue, is where the beat (or miss) hides—the mix between launch (lower gross margin) and space‑hardware (higher margin) moves the dial fast. Rocket Lab has surprised to the upside in three of the last four quarters Nasdaq, but with tariffs muddying cost inputs, management may flex conservatism.

My take

I’m still bullish long‑term. Rocket Lab owns a scarce asset: a fully‑operational, flight‑proven small‑launch platform with an adjacent space‑hardware business that already prints higher‑margin revenue. The Neutron program and defense wins give them line of sight to multi‑hundred‑million‑dollar annual run‑rates later this decade.

That said, macro remains the boss near‑term. I expect the stock to chop in a $15–25 band while the market digests every new tariff headline. If Thursday’s print is clean—say, revenue beats by 5 % and the call reassures on Neutron cap‑ex—RKLB can punch through $25 in a hurry and tack on another ~10 % as shorts scramble.

Bottom line: volatility is the price of admission, but the risk‑reward is still skewed up. I maintain a BUY rating and will happily add on any tariff‑driven dips closer to the mid‑teens. Strap in—earnings day could be a mini‑launch all its own.