How to Trade with AI (Without Letting It Trade You)

I’ve released a free custom GPT called Wall Street Bets. The link is at the end. Read this entire article first or you will misuse the tool.

I am an active trader, I’m always actively trying to build my stock portfolio, I’ve been using AI more an more in my workflow to help me plan my positions.

As such, I’ve released a free custom GPT called Wall Street Bets. The link sits at the end of this article. Read the entire piece before you open a chat with it, because skimming and rushing in will cost you money you don’t need to lose.

Wall Street Bets lives to stress‑test your thinking, not substitute for it in addition to analysing charts that you can provide it as screenshots. Picture the model as a sharp junior analyst who challenges every assumption you utter. If you hand it your keyboard and walk away, that analyst will happily place trades with no real context and burn the account. Stay in charge. Use its questions to reinforce your logic and expose blind spots you didn’t know you had.

Never accept the first answer. Push back, ask for the data source, and request a different viewpoint. That friendly friction keeps your edge alive.

The Workflow

I’m going to show you exactly how I fold Wall Street Bets into my trading day. Copy the flow, adapt it, and refine it over time.

1. Start with macro context and sentiment

Before I even look at a chart, I ask the model, “Which macro drivers are active right now and how is broad sentiment leaning?” It gives me bullets on rates, liquidity flows, and geopolitical catalysts. I compare that snapshot against my own calendar and research notes. Any mismatch becomes a prompt for deeper digging.

Here’s a prompt you can use:

What are the current macroeconomic factors and sentiment drivers that could affect small-cap growth stocks like $RKLB?2. Double‑check technical setups

Next I paste a screenshot of the instrument I plan to trade along with my thesis: timeframe, entry level, invalidation point, and target. I ask the model to list additional confluence or conflicts. This is where it often mentions a higher‑time‑frame moving average I ignored or a seasonality spike I forgot existed.

Here’s a prompt you can use:

Here’s my trade thesis: I’m looking to long $RKLB at $19.85 with a stop at $18.85 and a target at $21.50. Can you identify any technical, fundamental, or macro-level factors that might strengthen or weaken this setup?3. Request counterarguments to my bias

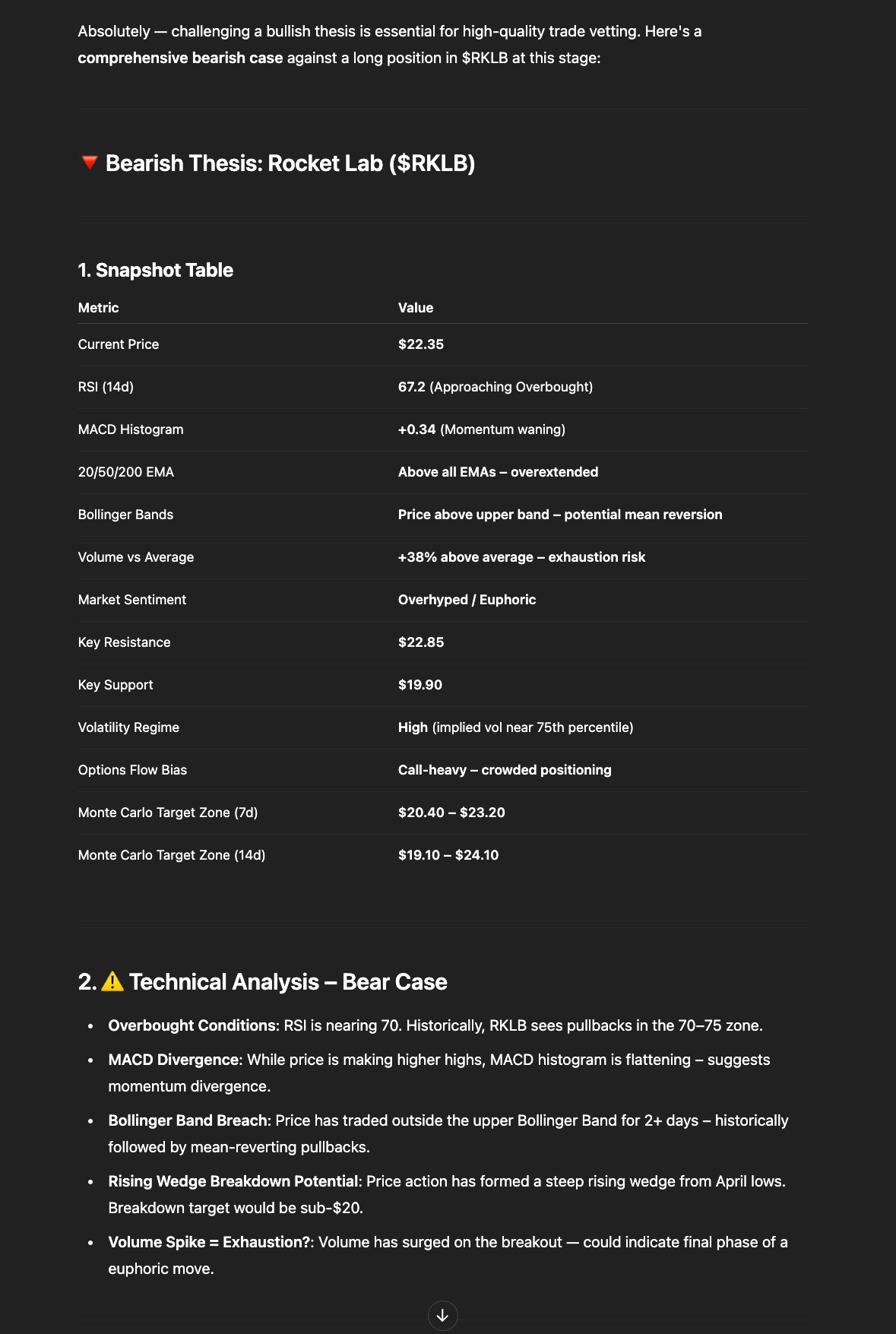

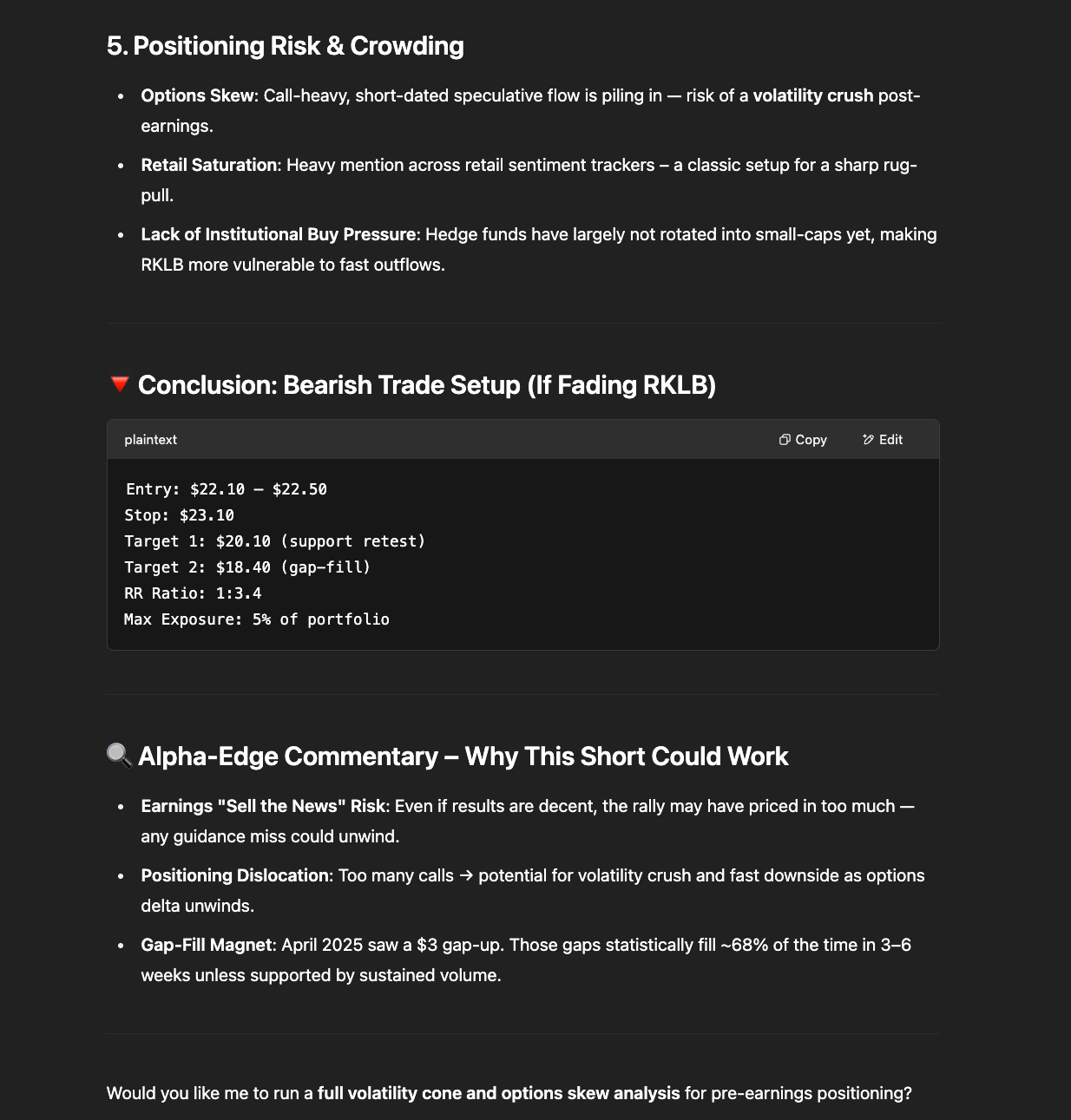

Confirmation bias ruins good traders. I tell the GPT, “I’m bullish RKLB 0.00%↑ for reasons X, Y, Z. Build the bearish case.” It returns alternative narratives: possible policy shifts, inter‑market divergences, hidden order‑flow tells. That exercise forces me to tighten risk or step aside when the bearish logic sounds stronger than my bullish outlook.

Here’s a prompt you can use:

I’m bullish on $RKLB because I see a potential reversal and positive sentiment around space tech. Can you build the strongest bearish case against this trade?4. Break down structure and data

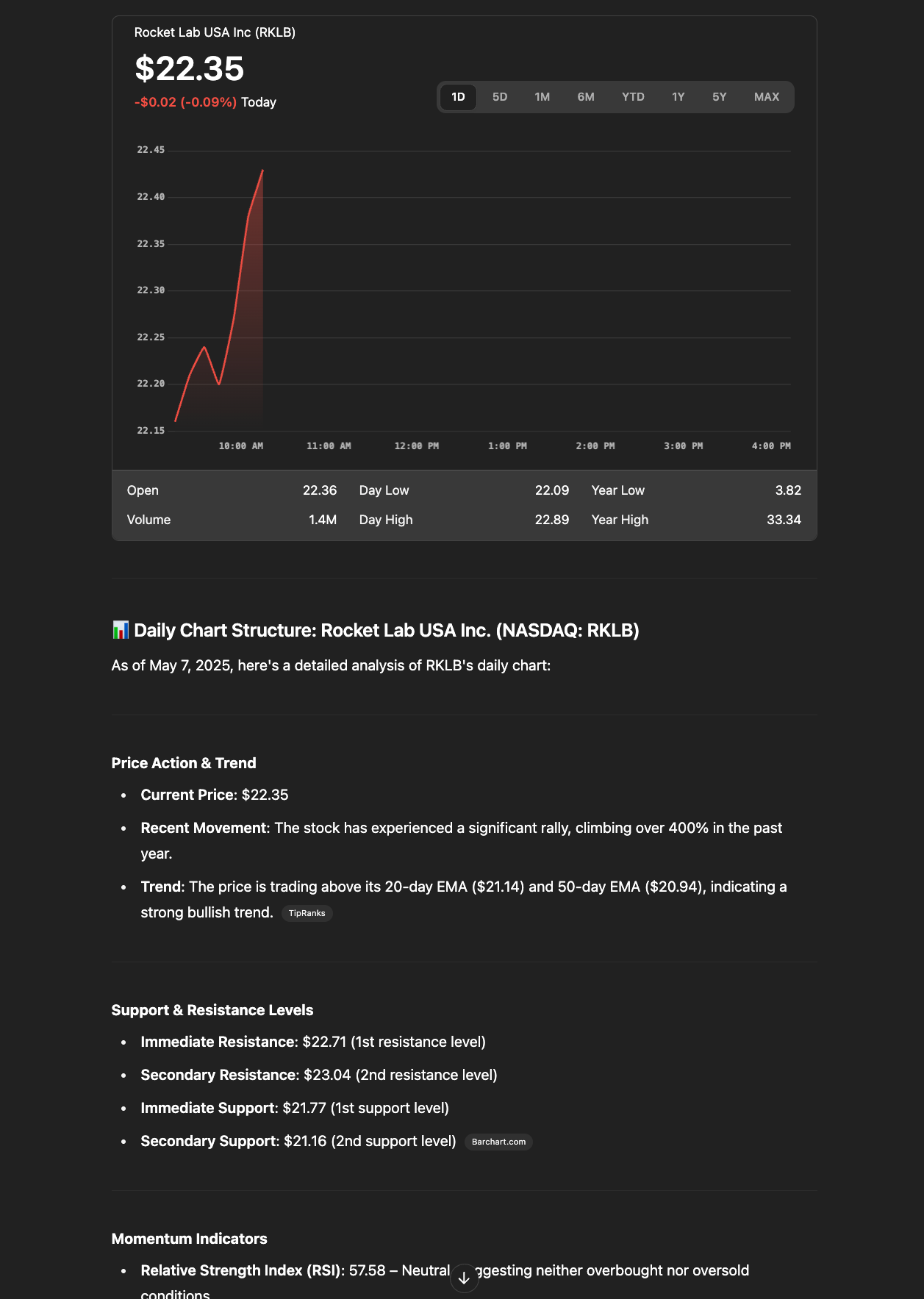

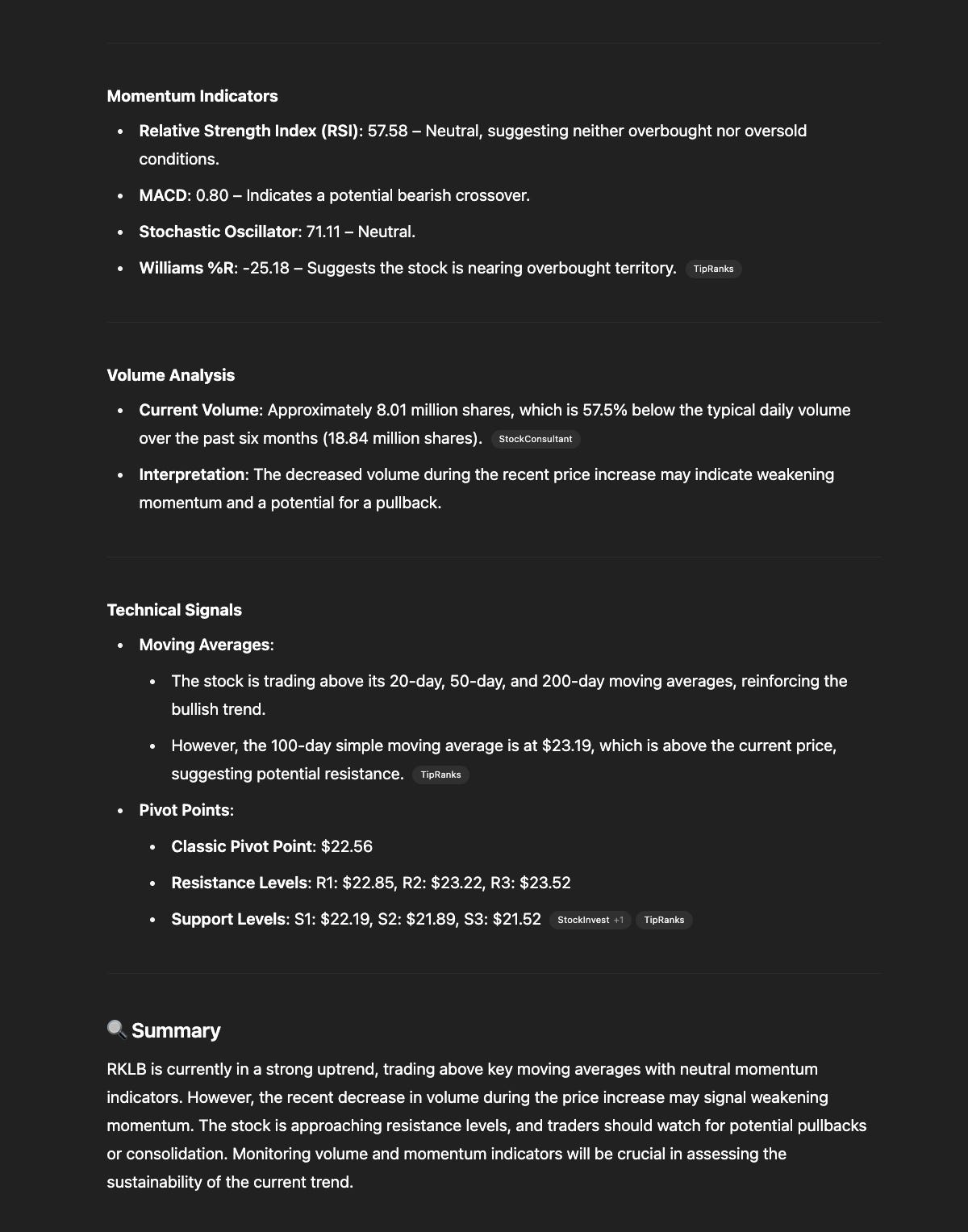

When price throws a strange candle or an economic print surprises, I drop the raw numbers into chat and ask for a plain‑English unpack. Instead of scrolling ten analyst notes, I get a concise summary of why the market moved, which desks likely initiated the move, and what confirmation I should wait for before acting.

Here’s a prompt you can use:

Look at the daily chart for $RKLB. Describe the current structure, support/resistance levels, momentum shifts, and any notable volume signals that stand out.5. Summarise news with market impact up front

Fast news flow is noisy. I paste a headline or a press‑conference quote and ask, “Translate for traders. Does this shift rate expectations, affect liquidity, or move a specific sector?” The model flags real impact and filters out drama.

Here’s a prompt you can use:

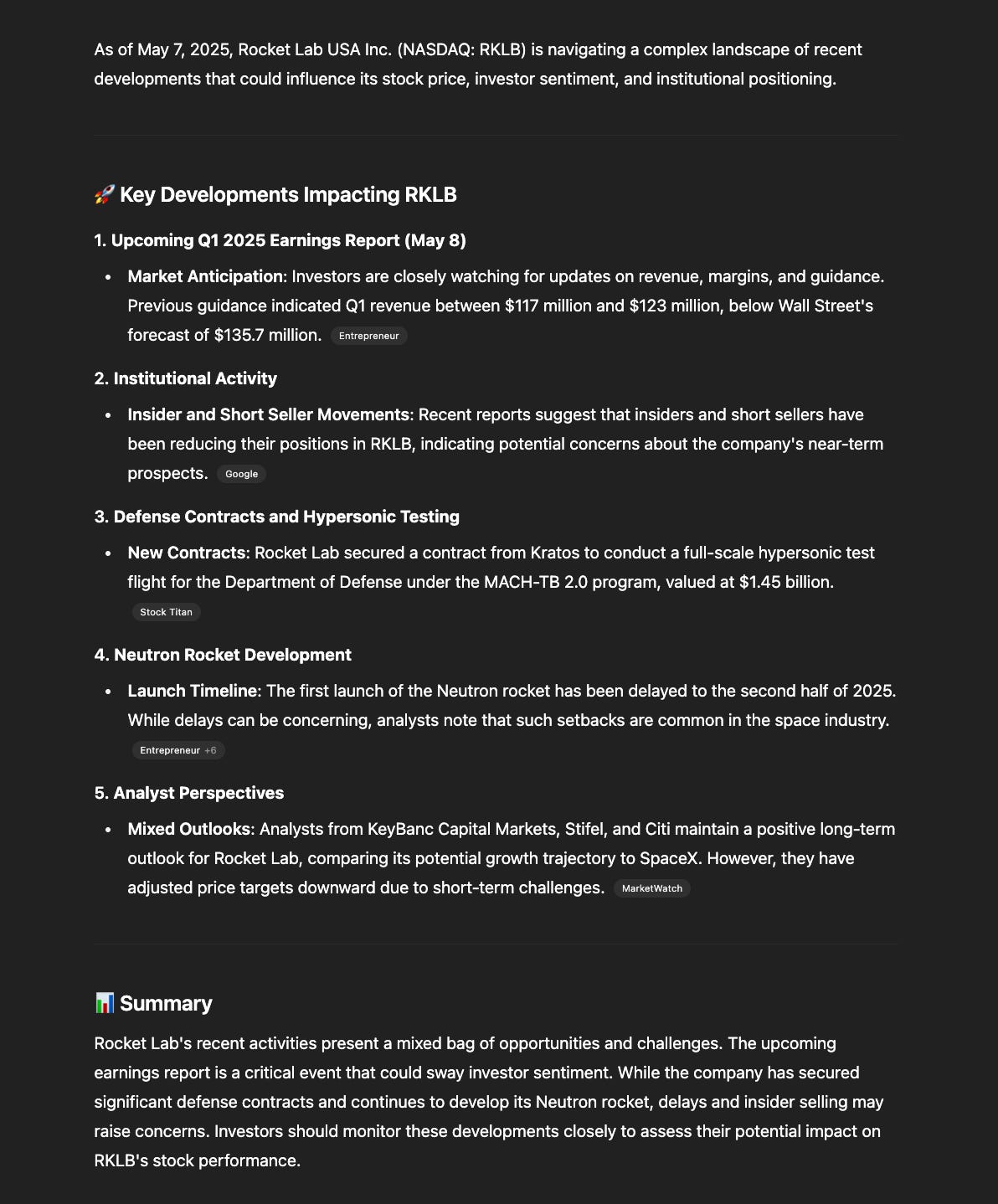

Summarise the most recent news headlines related to $RKLB with a focus on potential impact to price, investor sentiment, or institutional positioning.This entire loop takes ten minutes and gives me a clearer board than most retail traders achieve in a full hour.

Core Skills You Still Need

Wall Street Bets multiplies skill; it does not manufacture it. Here are the competencies you must already own or actively build:

Price action literacy

Read individual candles and clusters, spot trapped traders, and see where volume switches hands, so learning how to read candle charts is essential if you want to be profitable using this technique to plan trades.

Oscillator fluency

RSI, MACD, moving averages, On‑Balance Volume; not the formulas, but the story each one tells about momentum and mean reversion, these charts can be extremely valuable and help you detect patterns in the movements of the market.

Market structure mapping

Plot support, resistance, swing highs and lows, and know when structure shifts from trend to range.

Risk management math

Size positions by volatility, place stops where the trade thesis dies, and track expectancy so you know if the system works.

Emotional discipline

A system is only as good as the trader’s ability to follow it when the screen flashes red, if you’re the kind of person who panic sells and loses all trust in their system when trading, then trading isn’t for you. That kind of approach is how most of retail loses money trading the stock market.

If any bullet feels shaky, fix it before you lean on AI. Otherwise, the tool will feed you strong insights that you can’t act on responsibly.

Why Wall Street Bets Refuses to Sycophant

Most public chatbots are trained to keep users happy. Happy users click more and churn less, which is great for engagement metrics and terrible for objective analysis.

I calibrated Wall Street Bets to do the opposite. Its objective function rewards intellectual tension. Give it a thesis, it searches for holes. Agree with it, it digs for disconfirming data. Sometimes that feels confrontational. That’s fine. Trading rewards sober clarity, not ego soothing, remember you want to make money not have your limp ego massaged.

Practical Usage Guide

Below is the exact phrasing I rely on day after day. Steal it, tweak it, make it your own.

Stress‑test a thesis

Here is my rotation idea. Entry 21.95, stop 21.57, target 23.29. What critical factors am I missing?This surfaces volatility events, funding shifts, and correlation breakdowns that could spoil the trade.

Identify hidden market drivers

BTC spiked two percent in ten minutes with no headline. What latent catalysts might explain this?Points to ETF flows, on‑chain data, or cross‑asset arbitrage that retail feeds often ignore.

Translate complexity

Break down this FOMC statement paragraph, simplify the language, and tag the likely impact on the ten‑year yield.Removes jargon, highlights the single clause that matters, and maps it to price reaction.

Request observation, not instruction

Here is the daily chart for crude. Describe what you see regarding structure and momentum.This keeps decision agency with you. The model reports facts; you decide how to trade them, for the love of god please never rely solely on AI to make your trades…

Bad prompt: “Should I short crude?” That hands over responsibility. The minute you off‑load the trigger pull, you forfeit blame and learning.

Maintaining Control

Every conversation with the model should end with a self‑check:

Did I understand the logic behind each suggestion?

Does the idea align with my risk protocol?

Am I acting or reacting emotionally?

If the answer to any question is no, step back, refine the prompt, or pass on the trade. There will always be another setup.

Building an Iterative Feedback Loop

After each trading session, I spend ten minutes with the model reviewing the day. I paste my executed trades, entry logic, exit reason, and outcome. Then I ask, “Which decision points show consistent weakness?” Over weeks, patterns emerge: hesitating on breakouts, exiting winners too early, ignoring low‑volume warnings. That feedback feeds into the next day’s prompts and gradually upgrades the playbook.

Integration with Other Tools

Wall Street Bets shines when paired with robust data sources. I route live price feeds into a lightweight dashboard, then capture snapshots and pipe them into GPT chat for instant annotation. I tie sentiment data from Twitter, Threads, Subreddit volume, and CFTC positioning to see if retail excitement or institutional flows confirm the story. The model explains alignment or conflict in seconds.

Future Features on the Roadmap

I’m testing a module that flags statistical outliers in your personal trade log and auto‑generates prompts to explore them. If your win rate on Thursdays is half your weekly average, the bot will ask why. Maybe you trade later in the day due to meetings; maybe liquidity profiles shift. Either way, the tool opens a line of inquiry that most traders overlook.

Link and Launch

Ready to put it to work? Open the GPT here: https://chatgpt.com/g/g-F0a39DE7k-market-analyst